Changing minuses to pluses

An investment fund based on a decades-proven business model

We offer investors a way to evaluate their available capital

We are a Czech investment company focused primarily on portfolios of non‑performing loans (NPLs).

We operate in global markets and are constantly looking for new investment opportunities. For investors, we create anticipated return of up to 10,0 % p.a.

At the time of financial sensations and crypto speculations we are bringing an investment opportunity to the market that stands on a business model proven throughout decades.

How does it work

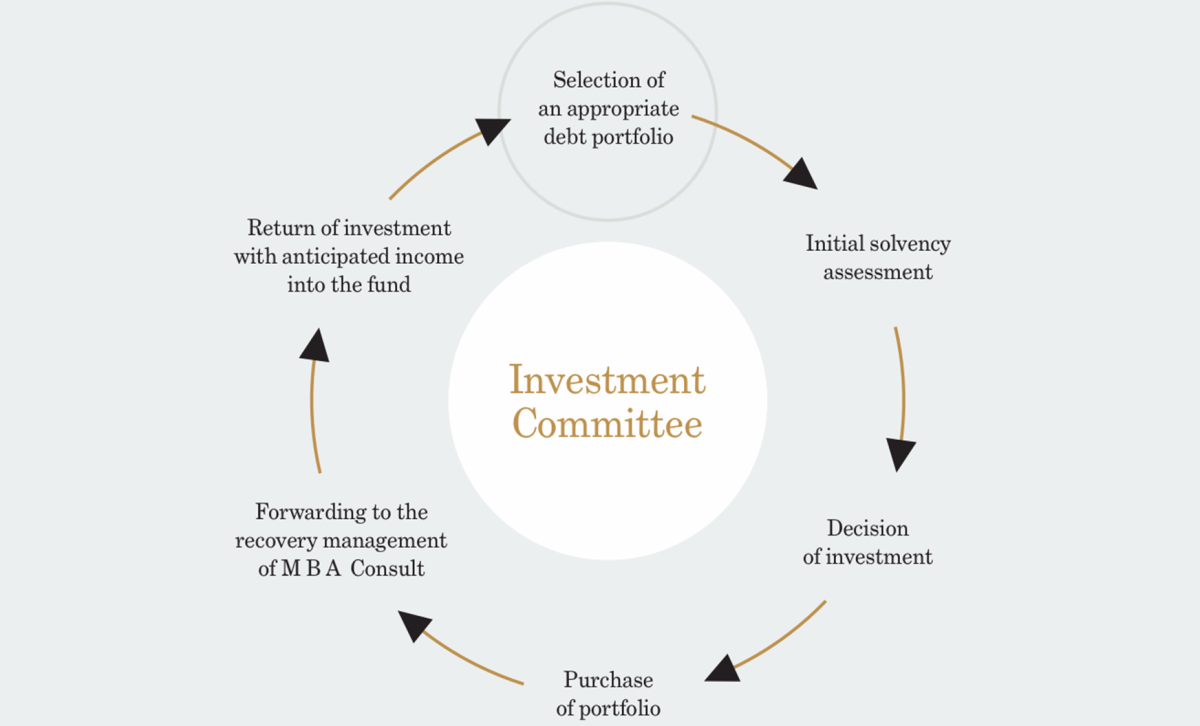

Analysts at r2p invest are looking for new investment opportunities in the debt market, particularly in Europe, Central and Southeast Asia, and America. We invest in the most lucrative receivables through our local SPVs - special purpose vehicles.

10,0% p.a.

Anticipated return for investors, up to

Time test

Regardless of the income threshold amounts, any income from the sale of securities that has met the so-called time test is exempt from tax and does not have to be reported on the return. That is, the period between the purchase and sale of the security exceeds 3 years.

Notice

The value of an investment in a fund can go down as well as up and the return on the amount originally invested is not guaranteed.

r2p invest's investment strategy is, through its subsidiaries, to find and invests in proven portfolios of European and Central Asian debts.

These are then managed by a reputable company MBA Consult, which have been operating on the market since 1996 and is a leading international collection company in the CEE Region, China, India, Indonesia, the Philippines, Singapore and Kazakhstan. After the collection of debt by respective SPV, the funds valuated by interest return to the fund, and the entire process can be repeated.

Documents for Investors

Memorandum, key investor communications, annual reports and much more.

View all important documents.