Administration of fund

r2p invest SICAV, a.s.,

IČO 275 90 241

is a fund of qualified investors. Investor of our fund may only become a qualified investor within the understanding of Section 272, Act No. 240/2013 Coll., on Management Companies and Investment Funds by Czech law.

Investment company warns investors that the value of the investment in the fund may fall as well as rise, and the return of the originally invested amount is not guaranteed. The efficiency of the fund in the previous periods does not guarantee equal or better efficiency in the future. Investing in the fund is intended to achieve revenue at its medium-term and long-term holding, and is therefore not suitable for a short-term speculation. Potential investors should consider mainly specific risks that may arise from the investment objectives of the fund, as set out in the fund’s statute. The investment objectives are reflected in the recommended investment horizon, as well as in the fees and expenses of the fund.

The information contained herein is for information only and does not constitute a draft contract or a public tender under the provisions of the Civil Code of Czech Republic.

AVANT investiční společnost, a.s.

specialises in the creation and management of funds for qualified investors. In the last three years AVANT has become the fastest growing investment company in the Czech Republic and currently it is the largest investment company in the market of qualified investor funds at all.

AVANT investiční společnost, a.s. manages 169 funds with a total asset value of over CZK 100,6 billion as of 31.12.2022. AVANT IS gained its market position especially through its personal client approach, experience, flexibility and quality of serviced provided.

They invest managed funds in commercial real estates, residential projects, farmland, debts, equity investments in start-up projects or in existing companies to whom it helps in further development.

Sharing key information about the Fund (KID) is available at www.avantfunds.cz/informacni-povinnost. That information can be obtained in paper form at the headquarters of AVANT investiční společnost, a.s. CITY TOWER, Hvězdova 1716/2b, 140 00 Praha 4 – Nusle.

Investor who, through purchase of an investment share at a nominal value of the investment share gains share in the Fund’s property and the right to redeem the investment shares on terms of the statute at the current value announced by the investment company.

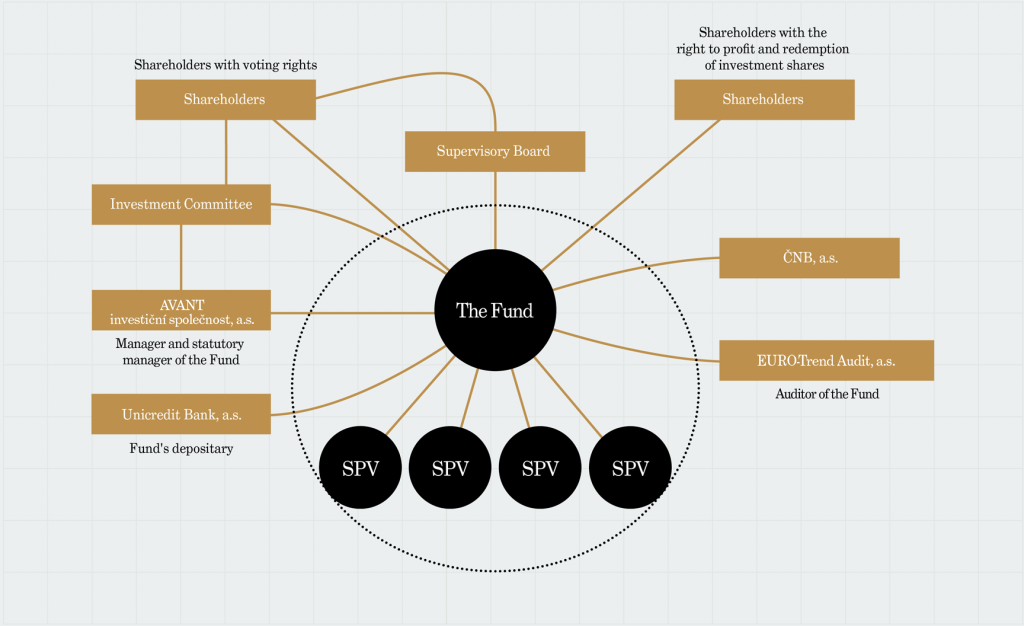

Auditor verifies weather or not the financial statements provides true and fair view on the financial position, economy and cash flow in accordance with czech accounting principles (EURO-Trend Audit, a.s.).

Česká národní banka – The Czech National Bank – grants licence to establish a fund, supervises the activities of the Fund, of the investment company and the depositary bank, requires regular reports on the management of the Fund.

Continuously monitors management of the Fund’s assets, purpose of each item on the Fund’s account must be documented to the depositary, provides custody of securities of the Fund (Unicredit Bank, a.s.).

Supervisory body of the Fund elected by the General Assembly of the Fund based on the Articles of Association, whose members are enrolled in the Commercial Register.

Investment fund for qualified investors pursuant to Sections 95 and 154 of the Act No. 240/2013 Coll., on Management Companies and Investment Funds (ZISIF). The Fund owns SPVs (100%), and provides loans to SPVs.

Every investment project must be assessed before the realization in an analysis of economic viability (AEV), which is processed by a risk manager of the investment company. AEV is afterwards presented to the Investment committee of the Fund which issues an opinion; and if opinion is positive investment project is then assessed and realized by Director of Fund’s Asset Management.

Manages the Fund’s assets accordingly with the statute of the Fund and in accordance with ZISIF, acts on its behalf, signs contracts for the Fund, fulfils duties of the Fund towards the state administration (accounting, taxes), ČNB (monthly reporting of financial statements, information on changes) and the depositary bank. The activities of the investment company are monitored continuously by the Depositary Bank and ČNB. The investment company informs the Fund’s shareholders about the value of the investment share, issues investment shares and keeps a list of shareholders (AVANT investiční společnost, a.s.).

Assesses individual investment projects based on the submitted analysis of the economic benefits viability and issues opinions for the investment company to be able to make decisions. It consists of 3 members appointed by the investment company; 2 upon the proposal of the founders of the Fund, and 1 upon the proposal of the director of the investment company’s asset management fund.

Determines the current market value of the portfolio.

Project company owned and controlled by the Fund that purchases from the Fund’s sources single portfolios of receivables.

Fundamental document defining the Fund’s investment strategy, investment limits, rules of decision-making and management of the Fund, the manner and frequency of calculating the value of the investment share, the terms and conditions of sale and redemption of investment shares, specifies the scope of activities of the depositary and information obligation of the Fund.

Statutory body of the Fund elected by the General Assembly of the Fund based on the articles of assiociation, whose members are enrolled in the Commercial Register (AVANT investiční společnost, a.s.).

Shareholder holding the founders’ shares of the Fund which carry the voting rights at the General Assembly, therefore the founder approves the Fund’s investment strategy and changes (Ing. Lubos Zovinec).

Subsequently, Silvia applied her skills in practice. First, as a controlling specialist at UniCredit Bank, and then her career progressed at KPMG, where she focused on the audit of financial institutions. There, Silvia demonstrated her ability to comprehensively evaluate financial operations and systems, contributing to her professional growth and solidifying her position as an expert in the field of audit. This period in her career was significant for the development of her professional knowledge and experience in the dynamic environment of the financial sector.

Since 2014, he has been engaged in AVANT investiční společnost, a.s., where he led the legal department and the compliance department (2014 – 2016) and since 2017 has been engaged in the management of funds for qualified investors focusing esp. on loans, equity capital in limited companies and real estate.